Runway Growth Finance (RWAY)·Q4 2025 Earnings Summary

Runway Growth Finance Misses Q4 Estimates as Portfolio Shrinks Ahead of SWK Merger

January 26, 2026 · by Fintool AI Agent

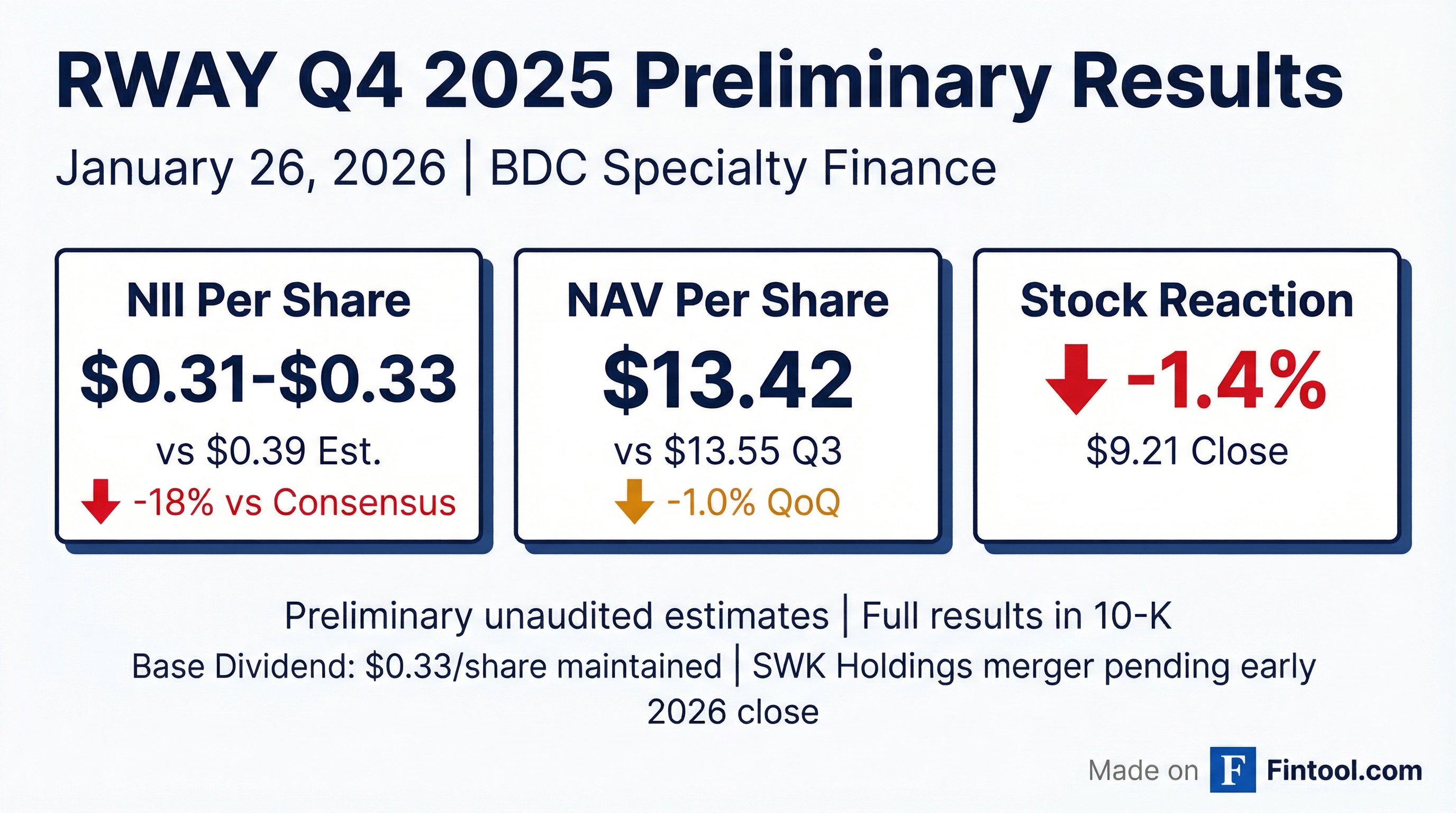

Runway Growth Finance Corp. (NASDAQ: RWAY) released preliminary Q4 2025 results today showing Net Investment Income (NII) per share of $0.31-$0.33, missing the $0.39 consensus estimate by approximately 18% . NAV per share declined 1.0% sequentially to $13.41-$13.43 . The stock closed down 1.4% at $9.21.

The miss was widely expected following management's Q3 guidance that Q4 would "cover the base dividend" as the portfolio rebuilds from heavy Q3 repayments .

Did Runway Growth Finance Beat Earnings?

No. The BDC's preliminary Q4 2025 results missed on NII while the dividend coverage slipped to roughly 1.0x from 1.3x in Q3.

*Values retrieved from S&P Global

Key drivers of the miss:

- Portfolio fair value contracted to an estimated ~$946M after $199.7M in Q3 repayments

- New originations take time to generate income—"deals tend to close at the end of the quarter"

- Prepayment-related income normalized after elevated Q3 ($0.10/share in Q3)

How Has RWAY's Earnings Trended?

The Q4 2025 miss extends a choppy earnings pattern for the specialty finance BDC. Over the past 8 quarters, RWAY has beat consensus 4 times and missed 4 times:

*Values retrieved from S&P Global

The volatility reflects RWAY's exposure to venture debt market dynamics—lumpy prepayments and origination timing create quarter-to-quarter swings that can be difficult to predict.

What Changed From Last Quarter?

Portfolio shrinkage. Q3 2025 saw $199.7M in repayments versus $128.3M in new originations, shrinking the portfolio by 7.7% . Management warned this would pressure Q4 earnings as new deployments take time to ramp.

Rate headwinds. RWAY's 97% floating-rate portfolio benefits less as the Fed cuts rates . Management noted spread compression, though "nowhere near" what's been seen in middle-market direct lending .

SWK merger delayed. Originally expected to close in late 2025, the SWK Holdings acquisition was pushed to early 2026 due to SEC delays related to the government shutdown . This delayed the earnings accretion management had projected.

What's the SWK Holdings Merger Story?

The pending acquisition of SWK Holdings is the key catalyst on RWAY's horizon. Announced in October 2025, the deal will :

- Scale the portfolio by ~$242M to approximately $1.2B

- Increase healthcare exposure from 14% to 31% of fair value

- Optimize leverage to ~1.1x (middle of target range)

- Generate accretion in the first full quarter post-close

The $220M transaction is structured as a NAV-for-NAV tax-free merger, with $75.5M in RWAY shares and $145M in cash . Notably, the external advisor is contributing $9M in cash—equivalent to nearly 3 quarters of fees .

How Did the Stock React?

RWAY closed down 1.4% at $9.21 on 290K shares—nearly double average volume—following the 8-K release .

The stock trades at a 31% discount to the preliminary $13.42 NAV, reflecting market skepticism about BDC valuations amid rate uncertainty and venture debt market headwinds.

What Are the Key Risks?

Portfolio concentration. Despite diversification efforts, individual loan outcomes can meaningfully impact quarterly results. Only one loan was on non-accrual as of Q3 (Mingle Healthcare, 0.2% of portfolio) .

Rate sensitivity. With 97% floating-rate assets, further Fed cuts compress NII . Management acknowledged "we were likely to see several decreases in interest rates" when rebasing the dividend .

Integration execution. The SWK merger adds complexity. While management expects synergies, transition services and portfolio integration carry execution risk.

Venture market dynamics. M&A and refinancing activity drove elevated Q3 repayments . If venture-backed companies continue to refinance at cheaper rates, portfolio churn could remain elevated.

What Should Investors Watch Next?

- SWK merger close — Expected early Q1 2026; SEC approval timing is the key gating factor

- Q1 2026 origination activity — Management's ability to deploy capital into attractive new loans

- Pro forma earnings guidance — First combined quarter outlook post-merger

- Dividend policy — Whether the $0.33 base dividend is sustainable as earnings mix shifts

Full Q4 2025 results and the annual 10-K filing are expected in March 2026 .

This analysis is based on preliminary estimates released January 26, 2026 . Actual results may differ materially upon completion of financial closing procedures.